The United Kingdom has the most active pension risk transfer market but despite it being more than a decade old, growth has been slow. We recently looked at a development in the U.K.’s pensions industry which could expand the market, so this month we wanted to see whether our readers felt that growth was indeed likely to accelerate.

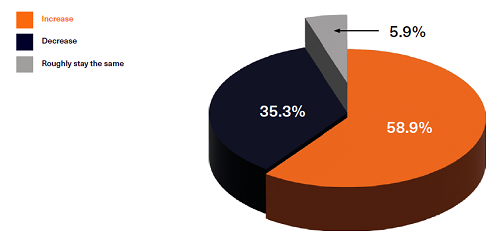

The results aren’t definitive. Whilst 58.8% think there will be an increase, 35.3% think activity will stay roughly the same. There could be many reasons for this, but two impediments to growth are a lack of talent and experience (from a number’s perspective, not a skill level perspective) and the time it takes to complete a pension buy-out, buy-in or longevity swap (not to mention the current uncertainty facing global markets and geopolitics).

Only 5.9% of respondents think the market will contract in the next five years. The pension risk transfer market will be hoping that they don’t know something that everyone else doesn’t.