Last year was one that many in the alternative investment industry would like to forget. Fundraising and deal activity fell significantly as investors rotated to liquid credit opportunities due to the relatively better yield offered by these products, along with a perceived lower risk when benchmarked against a more volatile geopolitical climate.

For those in the venture capital industry, add the collapse of Silicon Valley Bank in March and the resulting fallout amongst the start-up ecosystem, and you have something of an annus horribilis for the VC folks.

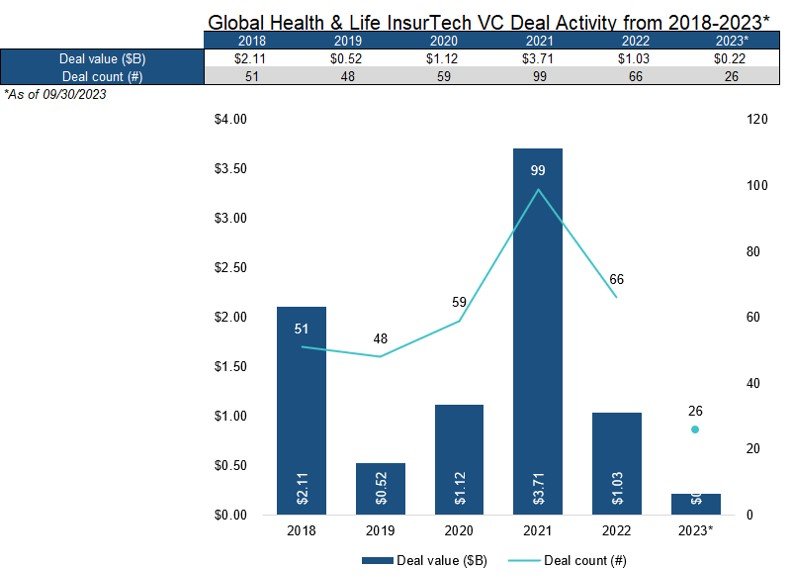

The venture capital-backed life insurance insurtech market certainly took a hit. According to data from PitchBook, through Q3 2023, the number of deals completed was just 26, less than half of the total for 2022 and only 25% of the total for 2021, and the total value of those deals was just $0.22bn, a fifth of the total observed in the previous year and down significantly from 2021’s banner year of $3.71bn.

Source: PitchBook Data, Inc.

Comparing activity in 2023 to prior full years isn’t quite an apples-to-apples comparison, because the data for last year only goes through the first three quarters; it’ll be another couple of months until the full year data for 2023 becomes available. But, unless the fourth quarter of last year delivers extraordinary numbers, it’s clear that 2023 will end up delivering a significant pull back.

Indeed, the life and health segment of insurtech that PitchBook tracks wasn’t the only segment that took a hit last year. All other segments were off when compared to 2022, with the industry globally halving in terms of deal value from almost $9bn in 2022 to $4.05bn in 2023 and the overall number of deals falling from 670 to 366.

Source: Pitchbook Data, Inc.

What’s notable for the life and health segment is that aggregate deal value reduced by more than the average. Keith Raymond, Principal Analyst, Insurance, at Celent, says that differences between how and why life insurance is purchased might be contributors to why VCs shied away from the space last year.

“High interest rates impact consumer spending by reducing discretionary dollars. Consumers must buy home and auto insurance to buy a house or a car, but they don’t need to buy life insurance,” said Raymond.

“And life solutions are generally more complex both from a product and a process perspective and can often require an agent or a relationship to navigate the purchase. P&C insurance is transactional and can mostly be done direct to consumer, and can also leverage some investments made in banking, which from a process standpoint is also transactional. VCs likely wanted to invest more defensively in 2023 than in previous years.”

That’s not all. Robert Le, Senior Emerging Technology Analyst at PitchBook, adds that there are factors idiosyncratic to the space which have impacted activity – or a lack thereof.

“For the most part there hasn’t been a lot of innovation in these areas. Early insurtech companies were able to convince investors that their digital distribution will lead to cheaper CACs. But for the most part, consumers still wanted to speak to a human when making health and life insurance buying decisions. This is evident in that most life insurtech companies have reverted to employing human agents over the past couple of years,” he says.

The S&P 500 delivered returns of approximately 24% in 2023, a significant increase that saw the index end last year close to all-time highs. Increasing investor confidence, as indicated by a rising public equity environment, and a plateauing interest rate regime might see 2024 return to growth in terms of venture capital fundraising as investors rotate back into illiquid assets, providing more ammunition to VCs looking to invest in the next insurtech unicorn.

“Based on both anecdotes (conversations with founders and investors) and data trends, we believe VC funding may have already bottomed out, and we expect an uptick in Q4 and increased funding in 2024. The publicly traded insurtech companies have recovered a bit in 2023, so that will lead to more bullish sentiment for the vertical in 2024,” says Le.

But that increased bullishness will not necessarily translate directly into a boomerang-style rebound in insurtech activity this year. There has certainly been an increase in the understanding of what works in the insurtech space in the past 18-24 months and there has also been something of an emergence of winners – or not – as well. This maturation of the segment has made VCs take a more cautious approach to the due diligence process, impacting deal activity. These trends means that, for Raymond, any increase in insurtech activity this year is unlikely to mirror the resurgent public equity market in the US.

“It’s true that various macroeconomic factors, including inflation and rising interest rates, coupled with market apprehensions and a constriction of liquidity in both public and private markets, have steered toward a pronounced correction in insurtech generally,” he says.

“But skepticism may linger among investors, particularly concerning the scalability and profitability of new technological integrations, which would steer them towards a more conservative approach toward insurtech for the foreseeable future.”