The concept of a life settlement investment is quite simple: the collected death benefits must exceed the cost (purchase price, premium payments, fees, etc.). A positive balance pays back to investors their initial investment and delivers a positive return once the initial investment has been paid off.

The dimensions of life settlements – life expectancy, age of insured, gender, projected premium streams – are unlike any other asset, so constructing a life settlement portfolio comes with a different set of challenges than other asset classes.

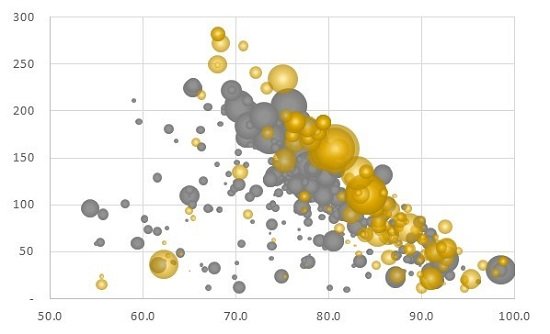

Figure 1 below shows a section of life settlement deal flow. The age of the insured persons [years, x-axis] is as low as 50 and goes up to close to 100 years. The life expectancy estimates [months, y-axis] reflect age, gender, and health of the insured persons. The size of the policies relates to the size of the dots. Policies referring to male insureds have grey dots, policies referring to female insureds have yellow dots.

The universe of available policies is rich. Each policy represents a unique combination of the various dimensions. And there is plenty of paper available in the secondary market (buying directly from the original owner) as well as the tertiary market (buying from other investors).

Figure. 1: Offered policies, July to November 2020

The accuracy of used life expectancies

The main issue in life settlement investing is that the accuracy of the life expectancy estimates is uncertain. The face amounts do not necessarily come due when they should (according to the obtained life expectancies). Consequently, the future cashflows are uncertain, which is a challenge since the premium payments are crucial to keep the policies in force. An investor can tie up higher cash reserves in order to deal with this uncertainty, but a higher cash reserve detracts from the performance.

The accuracy of the life expectancies is linked to other issues. There is still no requirement and/or standard for the medical underwriters to disclose the accuracy of their life expectancy estimates. Furthermore, the information for a transaction is provided by the sell side. The interest of the sell side is to achieve the highest possible price for a given policy, which depends ultimately on the life expectancy of the individual – the shorter the life expectancy, the higher the achievable price. The non-alignment of interest in combination with the information asymmetry between the sell side and the buy side overlays every engagement. This challenge needs to be carefully considered and dealt with by investors.

The key to success

History teaches us lessons; this is as true for life settlements as it is for any other asset class. It is therefore important to review and understand information regarding previous life settlement investments in order to avoid the mistakes of the past.

When it comes to the physical investment, it is all about the accuracy of life expectancy estimates and risk management. The importance of knowhow about the accuracy of life expectancy estimates cannot be overstated – this element was a dominant driver behind the investment results in the past and it will be the most important factor for investments today and in the future. And the accuracy of life expectancy estimates is linked to risk management. The absence of thorough information about the accuracy of life expectancies makes it hard to establish a robust risk management overlay.

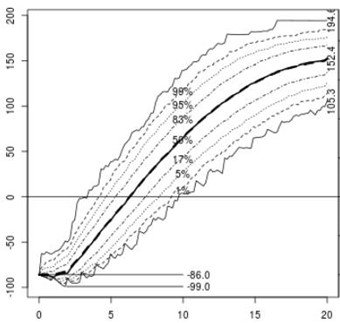

The accuracy of life expectancy estimates, and the risk management challenges are combined and visualised in Monte-Carlo simulations, as can be seen in Figure 2, below. This is a great tool to help understand the capabilities of an asset manager and how an investment could perform. The chart illustrates that life settlements can be a great addition to a well-diversified portfolio – if done properly.

Figure 2: Monte-Carlo Simulation of a Life Settlement Portfolio

The investment starts with an initial USD $86 million for the acquisition of the portfolio. The repayment of the initial investment is achieved via excess cash from collected death benefits over expenses (premium payments, fees etc.) after about seven years. Further excess cash leads to a positive return for investors. The bold line in the middle indicates the 50% probability under the assumption that the life expectancy estimates are correct overall. The other lines give an idea of the stochastic behaviour of the portfolio, i.e., the 83%/ 17% net cashflow probabilities assuming no longevity, and so forth.

It is not a challenge to buy policies – the markets are there, and investors can help themselves. The challenge is to buy policies which ultimately allow the investor to collect more cash from death benefits than they pay in premiums and fees. This is the art of life settlement investing.

Beat Hess is a Founding Partner and Gabriel Maeder is a Partner at AA-Partners

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association