Plenty of Interest in UK Equity Release Market Despite Down Year in 2023

At the beginning of February, UK trade group the Equity Release Council (ERC) published data summarising activity in the market for both the fourth quarter of last year and the full year.

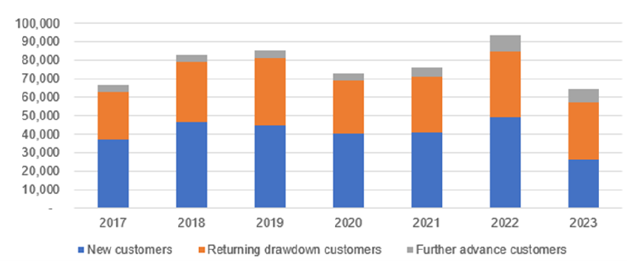

The bottom line was that 2023 saw the market serve its lowest total number of customers on an annual basis in the last seven years.

Figure 1: Total Equity Release Customers Served Annually 2017–2023

Source: Equity Release Council

Disappointing, but not surprising, given the prevailing interest rate levels in the UK.

“I don’t see demand recovering significantly in the short term. Ongoing increases in UK interest rates are resulting in higher interest rates on mortgages and low advances being made available to equity release mortgage customers, impacting customer demand,” Ben Grainger, Partner at EY, told Life Risk News back in July last year.

The Bank of England base rate currently stands at 5.25%, the highest level since early 2008. But it has remained there since August 2023, which is the longest period without an increase since rates began rising in December 2021, offering hope to those in the market that an upward turn will take place sooner rather than later.

But an upward turn in the demand curve is unlikely to be steep, according to Nicola Kenyon, Head of Insurance Investment and ALM, Insurance and Financial Services at consultants Hymans Robertson.

“Capital markets outlook for 2024 is more benign because markets are already pricing in future interest rate levels. There is plenty of interest in the ERM space from all participants – funders, originators and advisors – but it will take time for the market to bounce back to 2022 levels,” she says.

Still, there is plenty of money available to support the market and absorb any increase in demand. Insurers in the UK are awash with cash from their pension risk transfer activities, and equity release mortgages (ERMs) have attractive characteristics for their asset management function.

“The bulk purchase annuity providers – the main funders of ERMs – are looking for stable, secure, long-term assets to back their annuity portfolios, and equity release mortgages are one asset that tick all of these boxes,” says Kenyon.

One of the features of the funding model in the UK is that a securitisation market isn’t as necessary as it is in the US, where reverse mortgages are funded by lending firms. Securitising portfolios of mortgages provide lenders with additional capital to recycle back into the market, but insurers in the UK tend to hold the loans to maturity to get the matching adjustment benefit provided by the Solvency II regulatory regime.

There is, however, appetite from the market at large to expand the pool of funders.

“On the topic of securitisations, there have been some in the UK, but it’s nothing like the US market. The most likely sources of additional capital for the market would come in the primary market – pension schemes, insurers and reinsurers, for example, are looking at the space,” says Kenyon.

The increased interest in the UK’s equity release market can be evidenced by the ERC adding three new members just in the first quarter of this year – Hymans Robertson, Royal London, and Spry Finance.

But these firms, and their fellow members at the ERC, still face challenges in terms of moving the market even if / when interest rates begin to fall.

The 2023 Global Equity Release Roundtable Survey, a report published in late March from trade group the European Pensions and Property Asset Release Group (EPPARG) and consultants EY, asked industry participants in the equity release / reverse mortgage markets around the world about their views on the potential for future growth in the industry, and growth barriers and challenges.

UK respondents said that lack of awareness was the single biggest barrier to growth in their market, but efforts are being made to spread the gospel. The ERC held its inaugural Adviser Summit in November last year, an event specifically curated for financial advisers in the UK, to educate them about the space, to give just one example.

The EY/EPPARG survey suggests that the two largest markets, the US and the UK, will be worth more than $16bn and $8bn in 2035 respectively, both more than double 2023 levels. The confluence of an ageing, homeowning population that is faced with a retirement income gap is the main driver of activity in the market, and for Grainger, despite the current downturn in the UK market, overall, there is a positive outlook.

“Supporting growth in the global equity release market has the potential to transform thousands of people’s retirements, and it is positive to see such strong momentum currently,” he says.

“Unlocking the global potential further will require deeper cross-border collaboration, achieved by sharing funding models, sources and best practice customer standards. Progress is happening.”