Being a price-maker is the holy grail of any business, and in investment circles, those who originate business due to the strength of their network and reputation can often benefit, at least to some extent, from this advantage.

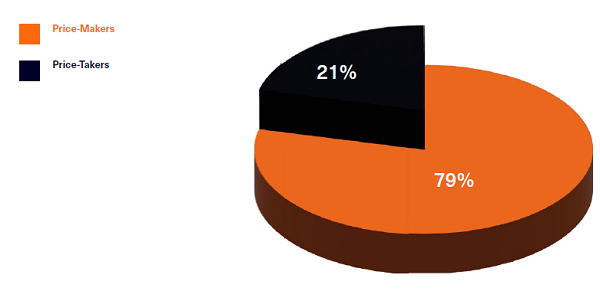

So, for our poll in January 2023, we asked our readers whether they thought that life risk industry investors were generally more price-makers, or whether they were really price-takers.

The fact that Life Risk News readers think they are generally price-makers should not come as a surprise. But what is surprising is the extent to which they think they are. Some 79% of respondents voted in the affirmative, versus 21% who didn’t.

There are many sub-categories of the life risk industry, from life settlements to value-in-force transactions, from equity release to life contingent structured settlements, each of which has nuances that determines the extent to which investors active in these markets are price-makers versus price-takers. What’s clearly not nuanced is the confidence that these investors have when it comes to their own ability to effect price.