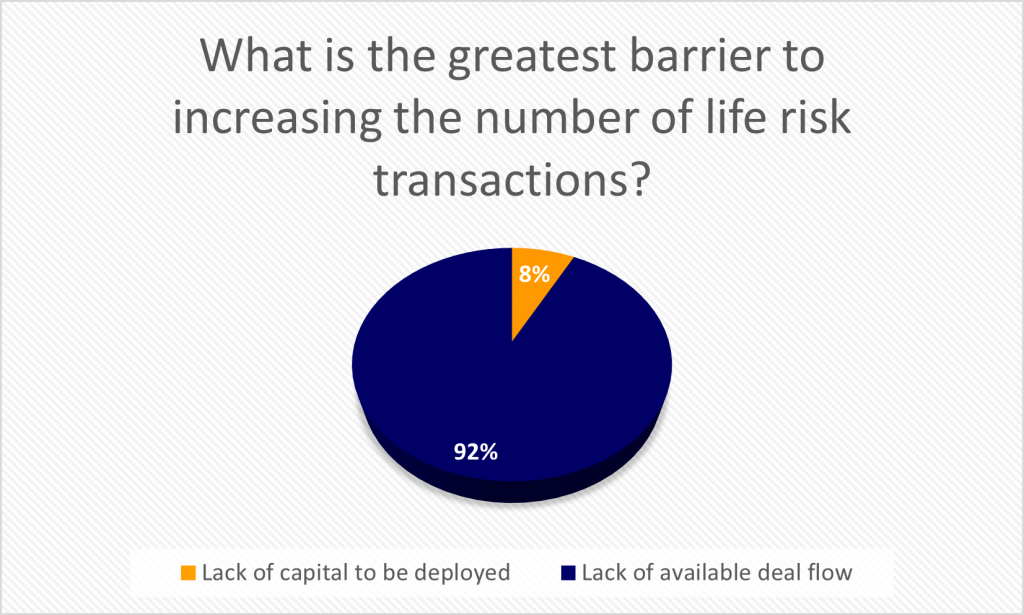

The market for the transfer of life-based risk to the capital markets remains an embryonic one despite some of the sectors in the industry being decades old. For Life Risk News’ most recent poll, we asked our readers whether the greatest barrier to increasing the number of these deals is one of demand – i.e., there isn’t enough money interested in these types of deals – or one of supply, where there aren’t enough deals to absorb the capital that desires a piece of the action.

Life Risk News’ readers overwhelmingly think that it’s a deal flow problem, with 91.67% of voters saying this is the case.

The result is hardly surprising but speaks to the structural challenges this industry faces in terms of figuring out how to move the needle. Many of the transactions in the space are bespoke, with little uniformity; more consistency is needed in order to accelerate deal flow to unlock the potential of this market.