Blockchain technology is all the rage, especially in the start-up and venture capital world, it’s apparent industry-agnostic applicability leading to billions of dollars of investment. In the life insurance and life settlement world, proponents argue that it can put all of the details about a life insurance policy in one place, eliminating the vast amounts of paperwork, both physical and digital, that prevail in the market today.

So, this month, we asked Life Risk News’ readers their thoughts on whether blockchain technology will be fully embraced by the life settlement market in the United States.

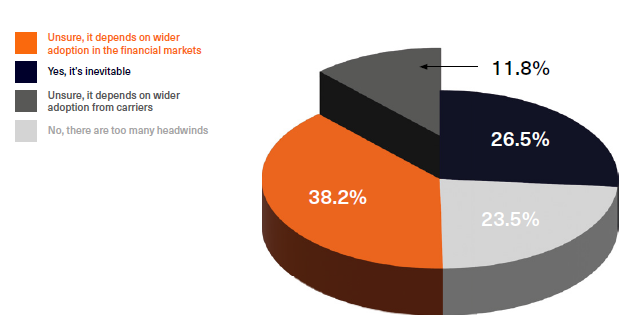

The results aren’t conclusive. Only a quarter – 26.5% – said that they thought it was inevitable and only 11.8% said that no, there are too many headwinds. That leaves approximately two thirds of survey respondents unsure. 23.5% say that adoption by carriers will be a driving force in terms of more widespread adoption, and 38.2% say that adoption by the wider financial markets will be the main driver.

The results perhaps speak to the still nascent state of blockchain technology and the comparative lack of adoption in business and industry generally. Who is right remains to be seen, but a recent development in the industry may well provide a kick start. In July, Abacus Life and Longevity Market Assets announced a partnership with BlockCerts Web 4.0 which will see Abacus Life transact a policy entirely on the blockchain. Those who care about such things will be keeping a keen eye on whether this is indeed the beginning of a new paradigm for the life settlement market.