The current macroeconomic environment – higher inflation, rising interest rates, the threat of recession – all factor into making this a challenging time for consumers.

The older population – at least, those who are homeowners – have the option to release liquidity from their homes via the equity release option (reverse mortgages in the United States). So, this month, we asked Life Risk News readers whether they think that we could see more activity in this market due to macroeconomic pressures.

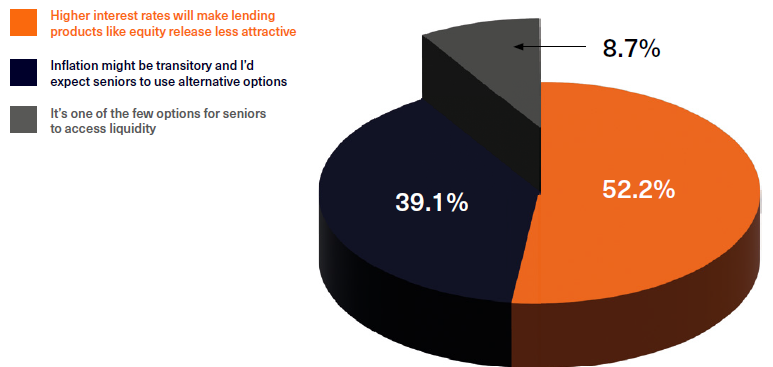

Surprisingly few think that the current environment will be a catalyst for more activity here – only 8.70%. Almost 40% are unsure, but more than 50% of Life Risk News readers say that they don’t think that equity release will see an uptick in activity. Whilst a rising interest rate environment impacts the equity release market via higher interest rates on these mortgages, ultimately, the estate of the mortgage owner foots the bill, so there is not a direct impact on the homeowner themselves.

There is great uncertainty generally at present with regards to just how long the current cost of living crisis will persist. But central banks and governments say publicly that they are committed to getting inflation under control. Homeowners in the older generation will continue to rely on alternative methods of funding in later life. It remains to be seen whether equity release – in a higher interest rate environment – will continue to be an attractive option for them.