Longevity risk is one of the largest risks that life (re)insurers are exposed to. Many firms maintain a longevity risk capital model, making sure the methodology remains relevant and proportionate to the risk. We shine a spotlight on these models here, considering how they may evolve with post-pandemic data and Solvency II reforms.

Throughout, we share insights from our 2024 longevity capital survey covering 15 firms in the UK market.

Consistency with best estimate (BE) assumptions

The pandemic has changed how BE assumptions are derived. Firms that use the CMI model are no longer fully including all years of data when deriving their trend assumption. Some have changed their approach completely, making new judgement-based adjustments outside of the model. The methodology within longevity capital models should be closely aligned to the approach taken to set BE assumptions. This is so that the true uncertainty underlying these assumptions can be assessed. Given this, we might expect to see corresponding changes come through within longevity risk models.

From our annual survey, we found that the vast majority (82%) had not made an additional risk allowance in their capital models for Covid-19, and most (71%) also didn’t think there had been a significant divergence between their capital and BE approach since the pandemic. This might be because the approaches didn’t align closely prior to the pandemic, and so any divergence since then is not particularly significant. For example, since the CMI model is not stochastic, it is not common for firms to use it directly in their capital models. Given the continuing evolution of the CMI model, we may see more firms bringing the model into their risk calibration process.

Overall, most firms aren’t making many changes to their models. This might change as the CMI model continues to evolve – we are expecting significant changes to be made in CMI_2024.

Use of post-pandemic data

Another puzzle within longevity risk models is how to make use of post-pandemic data. This is particularly important within the “new data risk” component of longevity trend risk, as discussed in a previous article.1

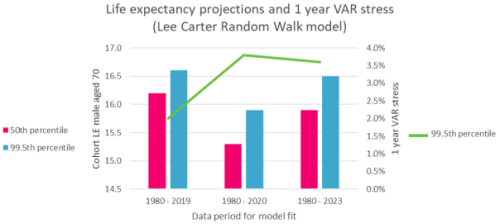

This risk captures the potential impact a new year of data can have on the future view of improvements. The size of the stress is driven by the volatility of the historical data. The chart shows how life expectancies and stresses change when different periods of data are used.

We can see that extending the pre-pandemic era data (1980-2019) to include 2020 has a big impact on the capital stress (increasing from c2% to c4%). It also materially reduces the overall life expectancy (at both the 50th and 99.5th percentile points on the distribution). Including data up to 2023 results in life expectancies which more closely align to the level seen prior to the pandemic, but the stress remains as high as when fitting to 1980-2020 data.

This suggests that, even once mortality data returns to a more stable level (as seen for 2023), the increased capital stress caused by the pandemic will persist within calibrations. Including 2020 (and 2021) in the historical data could lead to an overestimation of the risk, since these data points are unlikely to have been used to inform best estimate projections.

So how should firms deal with this issue? A temporary option is to not recalibrate the model and only use data up to 2019. This will result in the calibration becoming increasingly out of date. Alternative practical solutions in the longer term include:

- Adjusting the data to strip out the volatility in 2020/21. This is a simple solution but is a little clumsy and requires some care and judgement on how much they are adjusted.

- Developing the CMI model to be stochastic so that the same parameter framework (including 0% weight on pandemic years) could be used as in the best estimate. This would have the benefit of aligning the capital and BE methodology (as discussed above).

- Applying statistical techniques to identify outliers within the historical data, as set out by Stephen Richards in the 2023 IFoA paper Robust Mortality Forecasting in the Presence of Outliers.2 This provides a framework, but judgement is still needed to decide on the level beyond which data points are designated as outliers.

From our survey, c50% and c80% had not considered how their trend stress calibrations would include 2022 and 2023 data respectively, so this is an area that will require more thought soon.

Keeping “event risk” relevant

A big part of longevity risk models is “event risk” which considers the possibility that events, such as a medical breakthrough, could materially change expectations of mortality improvements. This component is normally calibrated by applying expert judgement to derive several scenarios.

Given the materiality of this component, the scenarios can be subject to significant scrutiny from independent validators and the regulator and often relies on input from medical experts. It is important to keep the scenarios relevant and up to date.

Firms will want to consider recent developments such as the use of AI within the medical sector, the recent excitement around weight management drugs and the advancements in cancer diagnostic programs including Multi-Cancer Early Detection (MCED) tests.

Solvency UK reforms

Another area of interest in relation to longevity capital models (and internal models more generally) is the Solvency UK reforms. The PRA has said it wants to make the internal model approval process easier. This news will be welcomed by firms looking to make Major Model Changes in the short-term.

These simplifications do not reduce the high-quality modelling standards required of firms. Firms will still need to validate their models to demonstrate they accurately reflect the risks and continue to do so over time. Updates to this validation process have been set out in SS1/244 including the need for CROs to do a written attestation on the quality and independence of the validation. This may increase the need for external validations.

We’re expecting to see lots of activity in the longevity capital space over the next few months. In particular for the insurers who have recently entered the BPA market, we might expect to see new models being built, or updates to existing models being needed to reflect any changes to their risk profile.

Megan Hart is a Senior Consultant and Ross Murray is Partner and Head of Longevity at Hymans Robertson

Footnotes:

- https://www.hymans.co.uk/media/uploads/The_impact_of_COVID_on_new_data_risk.pdf

- https://actuaries.org.uk/media/agklcl1d/robust2_-s_richards_26062023_sessional_27112023.pdf

This communication has been compiled by Hymans Robertson LLP, and is based upon their understanding of legislation and events as at date of publication. It is designed to be a general information summary and may be subject to change. It is not a definitive analysis of the subject covered or specific to the circumstances of any particular employer, pension scheme or individual. The information contained is not intended to constitute advice, and should not be considered a substitute for specific advice in relation to individual circumstances. Where the subject of this document involves legal issues you may wish to take legal advice. Hymans Robertson LLP accepts no liability for errors or omissions or reliance on any statement or opinion.

Hymans Robertson LLP (registered in England and Wales – One London Wall, London EC2Y 5EA – OC310282) is authorised and regulated by the Financial Conduct Authority and licensed by the Institute and Faculty of Actuaries for a range of investment business activities. A member of Abelica Global. © Hymans Robertson LLP.

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Life Risk News or its publisher, the European Life Settlement Association