In early November last year, industry group the American Council of Life Insurers (ACLI) published its annual Life Insurers Fact Book, the organisation’s deep dive into a range of sub-categories of the US life insurance industry. Last month, we looked at 2022’s developments in surrenders, new business and solvency; this month, we’re taking a look at the US life insurance market as a whole: Its health; size and outlook.

Ownership Trends

For a long while, US-based insurers have been, and remain, owned primarily by US investors and corporations. The percentage that is US-owned tends to hover around the 85-90% mark. In 2007, overseas ownership was at 10% with European and Canadian owners dominating that group. In 2015, a surge in Japanese ownership began which counteracted a slow retreat by European proprietors. Although the total number of US life insurers has steadily declined, from 1,009 in 2007 to 727 in 2022, the proportion in foreign ownership has remained fairly steady, although in 2022, there was a surprise uptick from 12.6% to 14.0%.

Measured by insurance liabilities, stock companies make up the largest share (61%), followed by mutuals (37%). A small amount of fraternal entities and other miscellaneous entities make up the remaining 2%. The proportion of companies which can easily have foreign owners is therefore lower (eg: not mutuals), meaning that foreign penetration into the US market is probably nearer 20%.

Among foreign owners, Canadian entities are the largest category by location with 25 proprietorships, which is to be expected, given the proximity and similar product structures between the US and Canadian markets. Then comes the next largest Western economy to the US, namely Japan (15), then a variety of Europeans which are as one might expect: Germany (5), France (3), Switzerland (10), Netherlands (2) and the UK (7). The rest tend to be tax havens in various Caribbean Islands and Central America. What stands out particularly, both this year and last, is the rise in Bermudan owned companies. In 2020 it was 14, in 2021 it was 17 and in 2022 it was 24. In 2010, before the first real surge in Bermudan ownership, it was just five.

In the UK, where companies fall under the Solvency II regime, there has been a steady drift towards insurers in the country using Bermuda, either for subsidiaries or captive reinsurers. This is particularly so for annuity business, which is the boom product line presently as corporations seek to de-risk their own pension liabilities with buy-outs or risk share arrangements. Although insurers can benefit from the Matching Adjustment concession within Solvency II, the regulations treat annuity business particularly harshly in their capital requirements. Bermuda is no soft touch but has a more flexible and responsive approach which the UK, and increasingly, European authorities, will acknowledge as having acceptable equivalence.

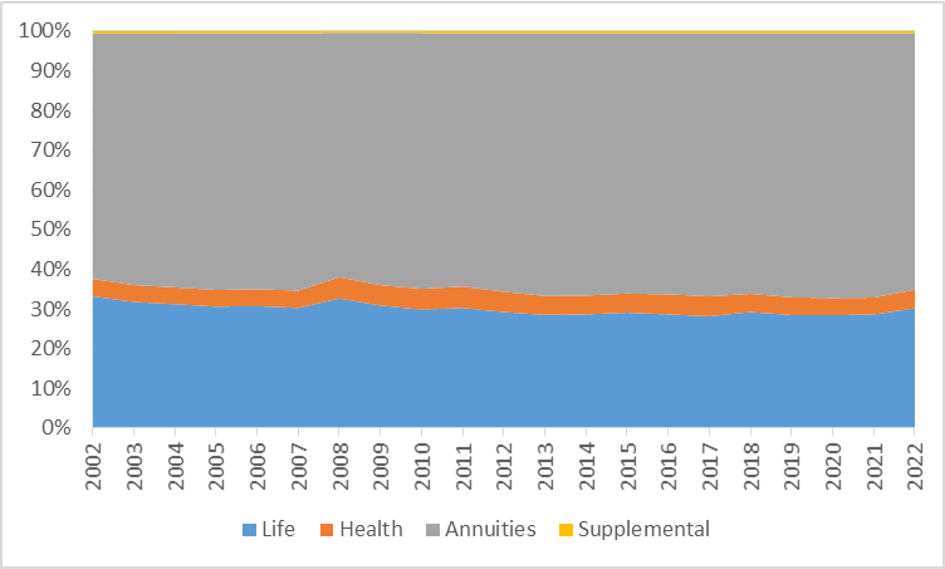

Figure 1: Composition of US Life Insurance (by value of liabilities) 2002 – 2022

Source: ACLI Factbook 2023

Well, the Brits aren’t alone. US annuity business liabilities as a proportion of total liabilities are not much different from how they were in the year 2000, unlike in the UK, but for similar reasons of capital efficiency, the same pattern is emerging for the US. Whilst US regulators maintain a watching eye over a potential emerging threat, nearly a third of reinsurance cessions in the US went to Bermuda in 2022. Bermudan insurers and reinsurers, many of which are actually US or European owned, generally benefit from the additional normal business flow but they themselves are often platforms for acquiring US (and European) businesses as well. XL Capital, for example, which is now owned by AXA, has been buying up primary insurance businesses around the world, including in the US.

US Life Insurance Market Size (by Liabilities)

Liabilities fell in 2022, largely as a result of a rise in bond yields increasing valuation discount rates. However, as the graph below shows, the rise in both total liabilities and life insurance liabilities has generally been growing over the past 20 years.

Figure 2: Life Insurance Liabilities 2002 – 2022

Source: ACLI Factbook 2023

Over the period from 2002, the compound rate of growth was 4.5%pa overall, although for the life segment there was some lag at 4.0%pa. Compared with the growth in US GDP over the same time period of 4.3%, these rates of business growth are not unexpected. There is no obvious sign of any change in that trend which might arise from changes in the fiscal framework in which they operate, or through societal developments.

There are some notable disjoints in the growth trajectory, notably in 2008 and in 2022. Measuring the market size by liabilities is imperfect because the liabilities themselves change, not just due to a change in the size of the business book itself, but due to a change in the discount rates used in their valuation – which themselves are affected by prevailing credit asset yields, particularly that on Treasuries or in swaps markets. The end of 2008 was deep amidst the financial crisis that year when asset values fell and yields spiked, and in 2022 we saw another system shock caused by the transition from quantitative easing-suppressed interest rates to higher rates driven by the outbreak of inflation.

Comparing the insurance liability totals with US GDP, we see the continuing, strong correlation – although, not a perfect one, especially during the Covid pandemic period when GDP fell. But insurance liabilities continued to be supported by all of the additional QE supplied by the Fed . In this chart, insurance liabilities have been rebased to the GDP value in 2002.

Figure 3: Life Insurance Liabilities (rebased 2002), US GDP 2002 – 2022

Source: ACLI Factbook 2023, World Bank

The insurance market continues to track the economy as a whole, which is a reassuring sign that it remains important to the US economy and is therefore recognised as such. The potential for political interference, such as the introduction of a disadvantageous tax change is always a threat, but history suggests that the industry maintains full government support across the political spectrum. The slightly lower growth rate of the life sector is a curious one and is probably explained by changing demographics, but because it is frequently a voluntary purchase, can be subject to ephemeral personal economic circumstances, with policies cancelled or allowed to lapse in times of hardship.

Solvency

The health of insurers is of vital importance to secondary investors such as life settlement and life ILS funds as well as individuals who want to buy new policies for protection purposes – and needing their insurer to be there when the fateful moment arrives.

Here, the ACLI Factbooks provide a historic record of aggregate solvency levels for the industry. Solvency can be measured in numerous ways, with different measures of ‘surplus’ capital and different benchmarks to compare against. The simplest are insurers’ capital ratios, either with the Asset Valuation Reserve and the Securities Valuation Reserve (two specific reserves to, in essence, smooth against temporarily depressed market values of assets) included or excluded. These ratios are insurers’ own capital and surplus and divided by their general account reserves.

Figure 4: Life Insurance Broad Capital Ratios, 1970 – 2022

Source: ACLI Factbook 2023

Perhaps a more meaningful ratio is one which might tell you if insurers are on the verge of triggering some sort of regulatory intervention, such as a cessation of new business or a full wind-down. Regulators prescribe a mechanism for determining what they consider the minimum capital for an insurer to be able to operate safely, and breaching this is usually that trigger, so measuring the actual available capital against that regulatory minimum (the Risk Based Capital (RBC) Ratio) gives the stakeholder a view on how likely it is that a breach may occur. This comparison has an added advantage in that regulatory capital calculations will flex with economic conditions, so at times of asset stress or buoyancy, the capital requirement will move with the assets – to an extent.

Figure 5: Life Insurance RBC Ratios 2002 – 2022

Source: ACLI Factbook 2023

Both charts show a degree of ebb and flow over the years with the financial crisis unsurprisingly being a stress event and the ratios for recent years also showing reductions when compared to the decade post-GFC. However, the ratio is remarkably stable and paints a picture of continuing health of the industry as a whole.

Roger Lawrence is Managing Director at WL Consulting

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association