Over 409,000,000 results returned from an early April 2022 Google search of these key words: “Low Interest” & “Environment” & “Alternative Assets”. If you refine the search and look only at the results from 2012-2014, the headlines look a bit different, yet the theme is the same. The bigger question is what unicorn investments are available to accrete when rates remain for some time at these current levels or begin to increase. With global debt levels at multiples of GDP in some countries, the quiet consensus is that rates are not “reverting to some normal levels”, which is difficult to even consider since my norm is different than your norm. Now is the time to step out of the hope strategy and focus on the fundamentals.

While the pandemic upended businesses and the markets in 2020 and shocked investment portfolios, investors worldwide have been contending with interest rate risk for several years, specifically the risk of persistently low interest rates. In fact, the 10-year bond yield in Germany has been negative since mid-2019 and currently sits at approximately -0.71%. In the US, Treasury rates along the entire yield curve have remained positive; however, the 10-year rate, despite a recent uptick, has been below 4% since 2008. Figure 1 below shows the historical downward trend since 1981 when the 10-year Treasury rate peaked at almost 16%.

Figure 1: Historical 10-year US Treasury Rate

Source: Macrotrends.net (thru March 28, 2022)

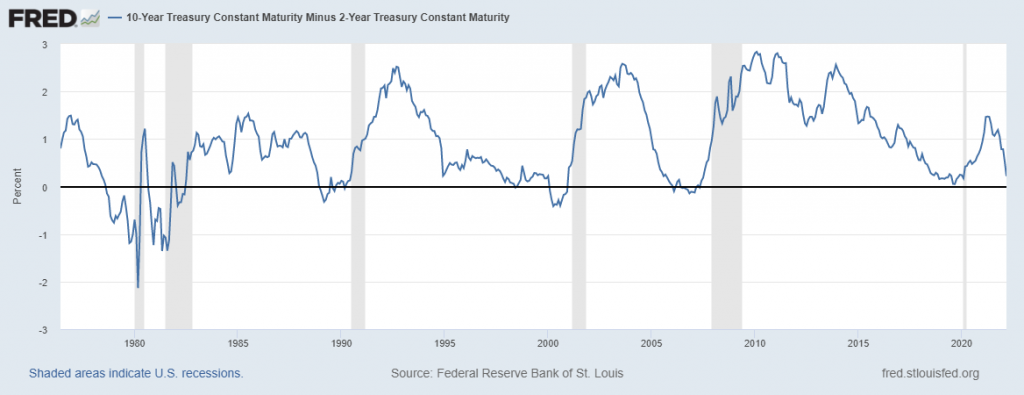

Not only has the 10-year US Treasury rate been persistently low, but the entire yield curve across all maturities has also flattened providing little opportunity for fixed income investors to achieve higher yields by extending the maturity of their portfolios. As shown in Figure 2, a large part of the past five years has been marked by an extraordinarily flat yield curve measured by the spread between the 2-year and 10-year Treasury rates. The current spread, after crawling back to around 1.25% -which was still historically low – spreads have fallen again to close to zero.

Figure 2: Historical 10 Year minus 2 Year US Treasury Yield Spread

Source: St. Louis Fed (thru March 1, 2022)

The persistently low interest rate environment has been especially problematic for fixed income institutional investors like pension plans and insurance companies who rely on asset yields to meet their liability obligations, some of which date well back in time and include promises made when interest rates peaked in 1981. Traditional fixed income assets such as bonds and mortgages only provide a spread over Treasury rates; however, a few asset classes offer portfolio diversification, and a special subset offer low correlation to traditional financial markets.

This special subset is perhaps best known as alternative assets. Some are possible to obtain yet most fall to institutional investors and/or (U)HNW investors. Most popular among alternative assets are private equity and hedge fund investments. Even less familiar to some are alternative assets ranging from art and wine to bitcoin to insurance linked securities (ILS). Specific examples of ILS include investments whereby the core risk is mortality (or longevity), like life settlements, pandemic bonds, or a disaster like with catastrophe bonds. While some of these investments can be less than fully liquid, they suit a more traditional buy-and-hold strategy. In all cases, these asset types are characterized by low or even negative correlations with the traditional asset classes, which allows them to reduce the overall portfolio risk through diversification. When the traditional asset classes underperform, alternative investments can continue to produce more stable returns which cushions the impact of traditional investments.

This low correlation is produced through the return generating mechanism of alternative assets. As a way of an example, in the ILS space, the returns on life settlements are generated by the mortality event of the underlying insured life that triggers a death benefit payment by the life insurance company (who underwrote the original policy), and ultimately to the life settlement “investor”. Mortality events generally are completely uncorrelated with the financial markets driving the returns of traditional asset classes. As is the case with “insurance” related risks, classified as the transfer of risk from one party to a commercial insurer for a “premium”, these ILS investments have some form of actuarial risk – like specific disasters (e.g., earthquakes), high health care (morbidity) claims vs expected, or a mortality event like with structured settlements, life settlements, equity release mortgages (ERM) and pension pay-outs. The analysis and evaluation of potential returns (and losses) on ILS investments is well informed by knowledgeable actuaries with a basis of relevant selections from a rich body of data. It is these same ingredients that have been well-modelled for decades by the insurance industry. As such these “insurance” themed alternative assets provide a different source of yield as compared to traditional asset classes.

Looking at one ILS type, life settlement investments specifically, the industry has evolved to allow investors to access their return potential and portfolio diversifying benefits through several vehicles including direct ownership in life settlement policies (equity), ownership in a security with the collateral being life settlement policies (debt only or some combination of equity & debt), and ownership of derivatives that are linked to the performance of underlying life settlements.

Regardless of the vehicle, life settlement investments can be described as a hybrid of an asset-backed security and a zero-coupon bond. The general economics of a life settlement, whether individually held, packaged as a pool for direct securitization, or held as collateral, requires an up-front acquisition payment to the policyowner followed by on-going life insurance premium payments to the insurance carrier who issued the policy. Ultimately upon the death of the insured, the insurance carrier provides a mortality-based benefit payment. During the period from the initiation of a life settlement transaction until the insured’s death, premium payments that potentially continue beyond the expected premium paying period may serve to add drag thus reducing the return for investors – this extension could be from the insured living longer, the need to pay more premiums into the policy due to policy changes, or some combination.

While sounding easy in principle to evaluate, the most critical aspect relating to life settlement investments is accurately predicting an insured’s date of death, and unless you have a great crystal ball, it is not possible to accurately predict that date for specific individuals. In the absence of precise predictions, investors rely on actuarial methods and assumptions to develop estimates of the expected remaining time to death of the underlying insureds based on professional underwriters performing an assessment on the insured’s health records and other pertinent predictable data points. While an actuary may not be able to precisely predict the date of death of a particular insured, the Law of Large Numbers enables actuaries to predict the expected remaining lifetime more accurately for a pool of insureds. Therefore, life settlement investment returns also involve a trade-off whereby a smaller number of policies supporting the investment result in a wider expected variance in returns (excluding the idiosyncratic mortality risk). So, with life settlements, as opposed to traditional asset classes, we are trading out core risks, like credit, market & interest rate, for one primary risk – longevity. Once understood, these unique forms of alternative assets can provide investors with a yield-generating outlet in this likely persistently below normal interest rate environment.

Corwin (Cory) Zass is Founder, Principal and Senior Consulting Actuary, Actuarial Risk Management

Any views expressed in this article are those of the author(s) and do not necessarily reflect the views of Life Risk News or its publisher, the European Life Settlement Association