The underwriting process in life settlements is crucial as it helps determine the fair market value of the policy by assessing a key pricing variable, the life expectancy. This assessment traditionally relied on manual reviews of medical records, actuarial data, and subjective interpretations by underwriters. However, with the advent of Electronic Health Records (EHRs), the landscape of life settlement underwriting is undergoing significant transformation.

Electronic Health Records are digital records of patients’ comprehensive health information, designed to be shared across different healthcare settings. They include virtually all components found in the paper records that comprise an insured’s medical history. In life settlement underwriting, EHRs potentially offer a more efficient and accurate method of accessing and analyzing an insured’s health data, which is pivotal in determining life expectancy and therefore, a fair price.

However, there are some challenges in utilizing EHR in an underwriting context. Before we address them, we should examine other electronically stored health information, which, when considered with EHR, comprise what is called Digital Health Data, and how they compare to EHR.

Types of Health Information in EHR

EHRs contain a vast array of health information that collectively provides a complete picture of an individual’s health:

- Patient Demographics: Basic data such as age, gender, ethnicity, and contact details. These are foundational for tailoring predictive models to specific population groups.

- Medical History: A detailed record of the patient’s past and present health conditions, surgeries, and treatments. This information is integral in assessing the insured’s overall health trajectory.

- Medication History: Includes all prescribed medications, dosages, and adherence information. This data helps underwriters understand how well chronic conditions are managed.

- Diagnostic Test Results: EHRs provide lab results, imaging studies, and other diagnostic tests, which are vital for evaluating the insured’s current health status and potential risks.

- Treatment Plans and Progress Notes: Physicians’ notes and treatment plans offer insights into ongoing health management and future health outlooks.

- Social and Behavioral Determinants of Health: These include lifestyle choices, social support, and socioeconomic status, all of which can significantly influence life expectancy.

While EHRs are increasingly recognized for their comprehensive nature, other types of health data, such as claims data, patient portal data, and prescription data, are also used in life settlement underwriting. However, these data sources differ significantly from EHRs in terms of depth, context, and usability.

Claims data consist of billing records generated when healthcare providers submit claims to insurers. These records typically include basic information about diagnoses, procedures performed, and services provided.

Comparison with EHR:

- Detail and Context: Claims data are transactional and often lack the detailed clinical context found in EHRs. They provide information on what services were billed but not on the underlying clinical decisions or patient outcomes.

- Comprehensiveness: EHRs offer a holistic view of the patient’s health, including unbilled interactions, clinical notes, and test results, making them far more comprehensive than claims data.

Patient portals give individuals access to a subset of their health information, often including lab results, medications, and appointment summaries. However, the data available through patient portals is typically limited to what the patient or their healthcare provider deems necessary to share.

Comparison with EHR:

- Scope: Patient portal data is a subset of EHR data, often lacking in-depth medical history, detailed physician notes, and full diagnostic test results.

- Utility: While useful for patient engagement, patient portal data does not provide the comprehensive detail needed for accurate life settlement underwriting.

Prescription data encompasses records of prescribed medications (filled), including dosage, frequency, and the dispensing pharmacy. This data is useful in understanding a patient’s treatment regimen.

Comparison with EHR:

- Context: Prescription data is focused solely on filled medications, without the accompanying clinical context that EHRs provide, such as why a medication was prescribed or how it fits into a broader treatment plan.

- Depth: EHR include prescription information (prescribed and filled) as part of a wider health record, allowing underwriters to see how prescriptions interact with other aspects of the patient’s health, offering a more nuanced understanding of their health status.

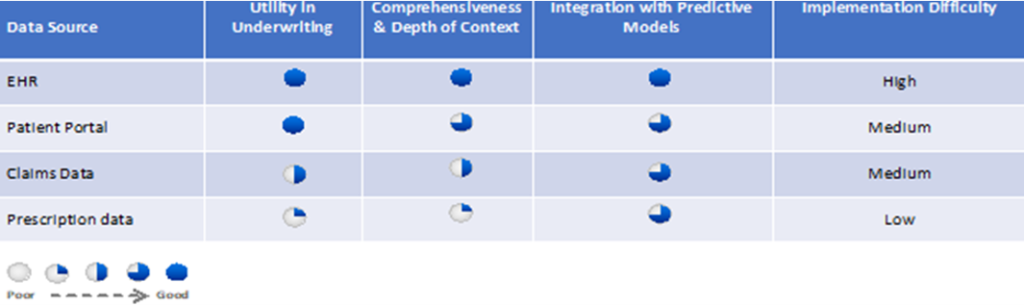

The chart below summarizes the realm of Digital Health Data and their application in life settlement underwriting:

Figure 1 Digital Health Data Sources and Life Settlement Underwriting

EHR Hit Rates and Quality of Data

Hit rates refer to the success rate of retrieving relevant and actionable health data from EHR systems. In life settlement underwriting, high hit rates are essential for making informed decisions. Current studies show that hit rates range from 30% to 45% in well-established healthcare networks. However, these rates can vary based on geographic location and the specific EHR systems in use.

High-quality EHR data is characterized by its accuracy, completeness, and timeliness. However, issues with data entry errors, or incomplete records, can impact reliability. Nevertheless, continuous advancements in EHR technology, normalization and standardization efforts are steadily improving data quality, making it more effective.

EHR Integration

Integrating EHR data into existing models or systems requires technical expertise and involves several key steps:

- Data Extraction: Extracting relevant data from EHR systems.

- Data Cleansing: Removing inaccuracies and standardizing data formats.

- Feature Engineering: Identifying and transforming data points into usable features in predictive models.

- Model Training: Training machine learning algorithms using historical data to predict outcomes based on current EHR data.

- Validation: Ensuring the model’s accuracy by validating it against real-world data.

EHR data continues to evolve and become more useable in their native state directly, being produced as organized data extracts of medical information and even summaries. Data users are creating interfaces, enabling underwriters to quickly access the relevant information they need. Moreover, integrating EHR data with existing underwriting systems streamlines the workflow, reducing the time and effort.

Challenges

Several challenges persist in the widespread adoption of EHR in life settlement underwriting:

- Data Standardization: Despite standardization of data formats across various EHR systems there still exists significant inconsistencies and variability of data leading to difficulties in interpretation and the creation of a cohesive medical picture.

- Hit Rates: There has been continuous growth in EHR hit rates, but increased availability is needed. Data providers continue their efforts to improve inoperability, standardization, and creating advance search algorithms to accelerate the hit rate growth.

- Regulatory and Compliance Issues: Navigating the complex regulatory landscape surrounding EHR data use and HIPAA remains a significant challenge.

- Integration: see below.

Integration

The implementation of EHR is fraught with technical and organizational challenges. Technical hurdles include integrating disparate EHR data sources and using NLP (natural language processing) with AI to synthesize large volumes of data. Education and training of industry participants who are accustomed to traditional underwriting methods is vital to successfully adopting EHR. It is also critical to establish a strategy on how to parse and analyze the voluminous data that is obtained. Clearly, this is not comparable to obtaining paper records and sending them to the underwriter. Significant IT resources, well-versed in underwriting, optical character recognition, AI and NLP, are crucial to having success.

Looking to the future, the role of EHR in life settlement underwriting is expected to grow. Advances in artificial intelligence and machine learning will likely enhance the ability to interpret and utilize EHR data more effectively. Additionally, emerging technologies like blockchain could address some of the privacy and security concerns associated with EHR data, potentially increasing the confidence of its users.

Studies from reinsurers suggest that EHRs will become increasingly integral to life underwriting processes. These organizations predict that as data quality improves and integration challenges are addressed, the use of EHRs will expand, leading to more accurate underwriting and better risk management.

In conclusion, the integration of EHRs into life settlement underwriting represents a significant advancement in the industry. EHRs provide a comprehensive and accurate view of an insured’s health, leading to more precise life expectancy assessments and better pricing of life settlement policies. However, challenges still exist and must be addressed to fully realize the potential of EHRs in this space.

Roger Tafoya is President & Chief Underwriter at Predictive Resources

Any views expressed in this article are those of the author(s) and may not necessarily represent those of Life Risk News or its publisher, the European Life Settlement Association